by Clark Kauffman, Iowa Capital Dispatch

January 26, 2026

A federal judge has criticized what he calls the “indefensible” actions of federal immigration enforcement agents in Iowa, ruling they illegally detained a man in the Muscatine... more

Despite being the hottest commercial corridor in Bettendorf, city officials are planning to dole out nearly $20 million in taxpayer subsidies to developers looking to expand the "bettplex" sports complex at Forest Grove and Middle Roads.

In addition to tax rebates totaling $14 million, the city would give developers $5.8 million in outright grants and agree to pick up the tab for all infrastructure improvements in the area at an estimated cost of $25 million.

In just the next two years, the agreement calls for the city to complete $5.3 million in public improvements including $1.5 million for a pedestrian bridge across Middle Road, $2 million for an extension of Forest Grove Road and a roundabout, $1 million for internal roads and trails in the development and $800,000 for storm water and sanitary sewer work.

And, unlike the first development agreement, the new deal would not require that developers share sales tax rebates with the city nor pay a $5 per night fee on hotel rooms planned as part of the expanded sport complex/urban renewal area on the northeast corner of Forest Grove and Middle Roads. (In the agreement released publicly 2/11, a clause to share sales tax rebates, if granted by the state, is included. The city would get a 45 percent cut of those rebates. And, a provision has been added to require hotels in the TIF area to charge a $5 per night room fee to be paid the city.)

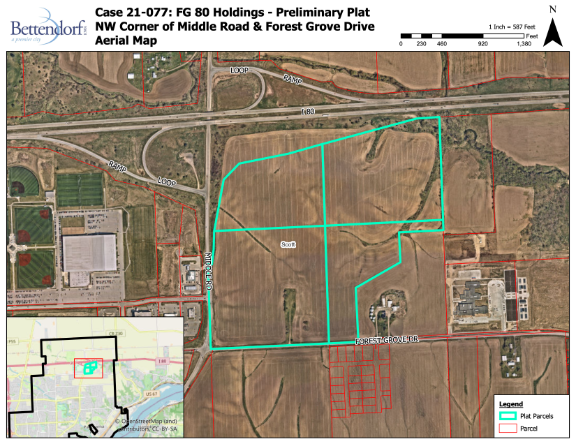

The developers who will receive the Tax Increment Financing (TIF) incentives and grants – Doug Kratz and Kevin Koellner – are the same developers who built the TBK Sports Center and surrounding commercial strip shops, hotel and service stations on the northwest corner of Middle and Forest Grove Roads. Incentives provided by the city for those developments totaled more than $15 million, not including Forest Grove and Middle Road improvements and sewer line upgrades to serve the area.

The development agreement is included as part of an urban renewal district expansion scheduled for a public hearing and approval February 15.

The plan has been under discussion behind closed doors at city hall for months.

The financial incentive package for the development has been the subject of so-called "three-on-three meetings" with aldermen and City Administrator Decker Ploehn.

To avoid public discussion before the full city council and general public, the city regularly schedules two meetings involving three aldermen, one less than an official quorum of the council. That avoids state open meeting laws that require public posting of meetings and allows public/news media attendance.

The 110-acres for the new development were purchased by the limited liability companies seeking the taxpayer subsidies last July for $5.33 million. The ag land, with development along Middle Road and Forest Grove and adjacent to Interstate 80, is among the most coveted locations for commercial use in the city and county.

City planning officials say traffic in the Forest Grove and Middle Road corridor has doubled since the sports complex and commercial businesses there opened two years ago, and they project traffic will double once again within the next few years.

To try to accommodate the extra traffic, the city has proposed adding three roundabouts and widening the lanes of traffic on Forest Grove and Middle Roads. The city is seeking federal and state grants to help pay for roadway improvements.

In a TIF, the city rebates to the developer the "incremental" taxes above the base property taxes paid prior to the development. Initially, TIF's were envisioned as a way to encourage developers to restore blighted or vacant commercial or industrial properties.

The rebate involves not only city property tax, but the taxes levied by other government entities including the county and affected school districts (Pleasant Valley in the case of the sports complex).

Under the incremental tax, city, county and school "debt" levies still must be paid, but additional levies that would otherwise fund services like police, fire, parks and public works are essentially borne by existing taxpayers over the life of the TIF. The TIF rebates sought by developers for the sports complex expansion, like the previous TIF for the sports complex, are for 20 years.

For the taxpayer subsidies, the developers "anticipate" constructing: two synthetic turf multi-use fields, sized to accommodate two collegiate/high school sized baseball fields; eight youth baseball/softball fields or four full-size soccer fields with lighting and parking; a golf entertainment facility consisting of a 3-story golf range with approximately 60 hitting bays; a restaurant and bar with meeting and entertainment areas; a commercial strip center(s), convenience store, and hotel.

According to the agreement, construction is expected to begin in April.

by Clark Kauffman, Iowa Capital Dispatch

January 26, 2026

A federal judge has criticized what he calls the “indefensible” actions of federal immigration enforcement agents in Iowa, ruling they illegally detained a man in the Muscatine... more

by Robin Opsahl, Iowa Capital Dispatch

January 22, 2026

Iowa House Democrats released a proposal Thursday aimed at improving the quality of Iowa’s drinking water and waterways through increased monitoring and more incentives for farmers... more

by Cami Koons, Iowa Capital Dispatch

January 15, 2026

Chris Jones, an author, researcher and Iowa water quality advocate, launched his campaign for Iowa secretary of agriculture Thursday outside of Des Moines Water Works.

Jones’... more

by Clark Kauffman, Iowa Capital Dispatch

January 15, 2026

A federal judge has ordered the Muscatine County Jail to release an ICE detainee who had been incarcerated for almost a year after a judge ruled in his favor on an asylum request... more

Powered by Drupal | Skifi theme by Worthapost | Customized by GAH, Inc.